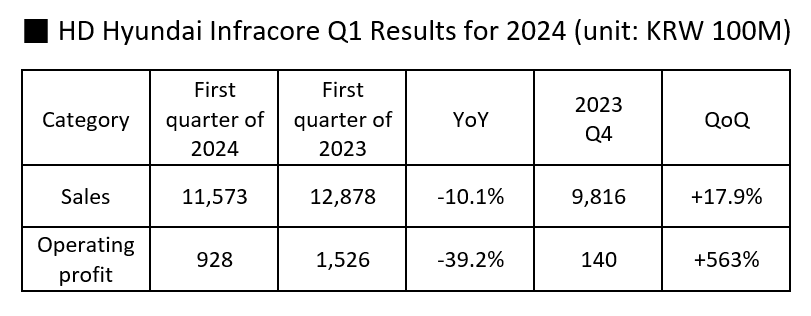

▶ Recorded sales of KRW 1.1573 trillion and operating profit of KRW 92.8 billion

▶ Solid 8% operating profit margin driven by steady growth across engine divisions

▶ “Expects construction equipment demand to rebound in the second half, maximizing profitability through sales of large equipment and strengthening of sales and product competitiveness”

HD Hyundai Infracore announced that it recorded first-quarter sales of KRW 1.1573 trillion and operating profit of KRW 92.8 billion in a financial disclosure on April 19, 2024 (Friday).

Sales fell 10.1% compared to the previous year as the global construction equipment market contracted. Operating profit plummeted 39.2% year-on-year despite the robust performance of the engine business division. Such decline was primarily attributed to a slump in construction equipment sales.

By business division, the Construction Equipment Division's sales last year fell 13% to KRW 848.1 billion compared to the previous year due to the base effect and sluggishness in developed and emerging markets. Despite the selling price hike and stabilization of raw material prices, operating profit also shrank 55% to KRW 45.8 billion due to a drop in sales.

Even as the global market tightens, a positive rebound trend has been observed in major countries within the market. In the developed North American and European markets, retail sales grew and market share increased thanks to the launch of new products, cross-selling of affiliate products, and promotions by strategic dealers. In the Korean and Chinese markets, a rebound is expected after hitting the bottom, showing a gentle recovery trend.

The Southeast Asia and Oceania regions recorded a market revenue rate that exceeded expectations through regional sales activities such as the identification of key customers by the Indonesian subsidiary and the strengthening of the Australian dealer network. HD Hyundai Infracore is gearing up to broaden its reach in Latin America by establishing a sales subsidiary in Mexico during the second half of the current year.

The engine business division exhibited consistent growth across all product categories including industrial engines, defense engines, and material components. Sales rose 1% to KRW 309.3 billion compared to the previous year, but operating profit fell 5% to KRW 47 billion. The company maintained a stable double-digit operating profit margin of 15.2%.

HD Hyundai Infracore officials expect demand for construction equipment—which has slowed down due to high interest rates—to recover in the second half of the year, and forecast the steady growth of sales of generator engines for data centers in North America and emerging markets as well as defense engines. "We will maximize profitability by expanding market share through enhanced dealer network competitiveness and product lineup expansion, including new products, and expanding sales of super-large construction equipment," they added.