South Korean shipyards' capabilities in building naval vessels have attracted considerable attention from various countries. Recently, the Wall Street Journal reported that the U.S. Navy needs to partner with South Korean shipyards, which have the technology and expertise to help maintain maritime dominance. Similarly, Bloomberg noted that the U.S. is struggling to produce the naval vessels it requires due to a decline in its shipbuilding industry and is actively seeking investments from allied nations, including South Korea.

The Top Exporter of K-Ships: HD Hyundai Heavy Industries

In fact, it’s not just the United States that is keeping an eye on South Korean shipyards. Many countries around the world have been looking to HD Hyundai Heavy Industries for naval vessels for their own fleets for quite some time.

HD Hyundai Heavy Industries has been exporting naval vessels to various countries worldwide since 1987, starting with the New Zealand auxiliary ship "Endeavour." South Korea has exported over 40 naval vessels to date, and HD Hyundai Heavy Industries holds the record for the most exports, having built 18 of those ships.

HD Hyundai Heavy Industries has also taken on modernization projects for the navies of specific countries, with notable examples being the Philippines and Peru. In 2016, after securing an order for two frigates from the Philippines, the company began exporting combat vessels in earnest. Since then, it has exported a total of 10 ships, including two 3,100-ton corvettes and six 2,200-ton patrol vessels, playing a key role in modernizing the Philippine Navy. Additionally, in April of this year, HD Hyundai Heavy Industries signed a contract worth 640.6 billion won with Peru's state-owned SIMA shipyard for the construction of four vessels. This agreement also secured preferred bidder status for future projects with the Peruvian government and Navy as a "strategic partner" over the next 15 years.

A rendering of the 3,400-ton frigate (center), 2,200-ton offshore patrol vessel (below), and 1,400-ton landing ship that HD Hyundai Heavy Industries has secured an order for from Peru

Strengthening Global Competitiveness through the Launch of the Naval Ship Research Institute

Shipbuilding projects are national initiatives aimed at strengthening defense capabilities. For the contracting nation, these projects are critical and leave no room for compromise on costs, performance, or delivery schedules. The reason K-Ships have been selected in this demanding field lies in their superior technology, efficiency, and project management. Among domestic companies, HD Hyundai Heavy Industries showcases exceptional technology in shipbuilding, leveraging the capabilities it has developed over the past 50 years in constructing commercial vessels.

In July, HD Hyundai announced its commitment to target the future naval vessel market, projected to be worth 113 trillion won by 2034, with the establishment of its Naval Ship Research Institute. This institute operates under HD Hyundai's R&D control tower, the Advanced Research Center of HD Korea Shipbuilding & Offshore Engineering. The institute aims to swiftly integrate advanced technologies in electrification, digital solutions, and artificial intelligence (AI), positioning itself favorably for securing foundational technologies for future naval vessels. HD Hyundai's strategy involves using the newly established Naval Ship Research Institute as a hub to pursue three core strategies in naval projects: 1) Electrification of naval vessels, 2) Development of unmanned vessels, and 3) Strengthening the competitiveness of export naval vessels. Additionally, the company plans to continuously expand its pool of skilled professionals in the naval sector.

Technological Excellence of the Aegis Destroyer: The 'Shield of God'

The most representative example of HD Hyundai Heavy Industries' naval technology is the Aegis destroyer Batch-II Jeongjo the Great, which is scheduled to be delivered to the South Korean Navy by the end of 2024. HD Hyundai Heavy Industries won the contract for the Jeongjo the Great in 2019. Construction began in earnest in 2021. The launching ceremony took place in July 2023 at HD Hyundai Heavy Industries in Ulsan, attended by President Yoon Suk-yeol. The Jeongjo the Great is expected to be delivered to the Navy after completing its ongoing test evaluations.

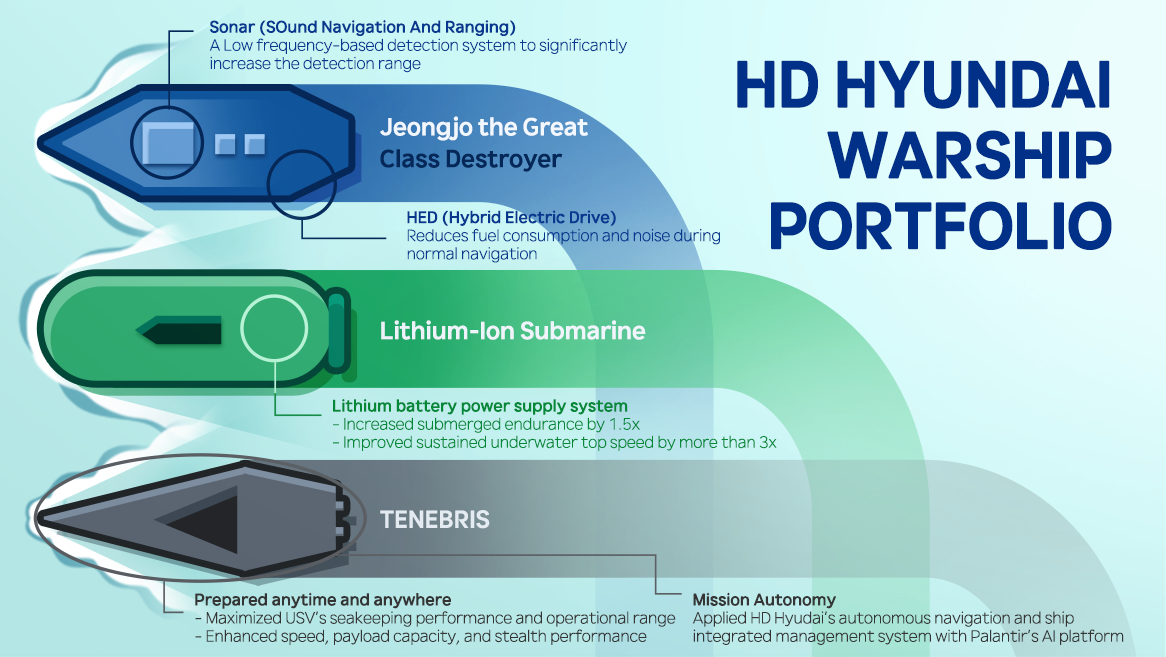

The Jeongjo the Great-class destroyer has achieved significant technological advancements compared to existing Aegis destroyers. One of its most notable features is the integrated Sonar (SOund Navigation And Ranging) system and a hybrid electric drive (HED), which dramatically enhance the vessel's anti-submarine defense and attack capabilities.

The integrated Sonar system developed with domestic technology comprises a hull-mounted Sonar, a low-frequency active towed array Sonar, and a multifunctional passive towed array Sonar. The most significant difference from traditional high-frequency sonar systems is the application of a low-frequency detection mechanism, which dramatically increases detection range.

The propulsion system has been enhanced by adding two HED engines to the existing four gas turbine engines, allowing for fuel savings and significantly reduced noise during regular navigation. In addition, the Jeongjo the Great-class destroyer has been praised for its dramatically improved anti-submarine defense and attack capabilities due to features such as the long-range anti-submarine torpedo Hong-sang-eo, the application of stealth to its hull, and the operation of MH-60R maritime operation helicopters.

*Sonar (SOund Navigation And Ranging): A device that uses sound waves to determine the direction and distance of underwater targets.

The next-generation Aegis destroyer Batch-II Jeongjo the Great is test driving

First Application of Lithium Batteries in Submarines

HD Hyundai Heavy Industries is leading not only in surface vessels like the Jeongjo the Great-class destroyer but also in the submarine field based on its technological prowess.

A representative example is the development of a power supply system for submarines using the country's first lithium battery (lithium-ion polymer). Once a submarine submerges, it is cut off from external air, making engine operation impossible. Therefore, for underwater navigation, it is necessary to use energy storage devices, such as batteries, to supply power.

Lithium batteries have superior energy storage capacity and can be made lighter compared to the batteries that have traditionally been used in submarines. This advantage is maximized when applied to submarines, which have limited space. In particular, lithium batteries are considered to have significantly improved safety compared to the commonly known commercial lithium-ion batteries.

The lithium batteries applied by HD Hyundai Heavy Industries in submarines have obtained international safety certification from the German Institute for Industrial Certification (TÜV). Pre-operation tests under conditions identical to actual equipment in a Land Based Test System (LBTS) have been conducted, which implemented the submarine's power supply system on land, and received recognition for performance. Since then, they have been mounted and operated on actual submarines, continuously verifying performance, safety, and reliability for approximately eight years, including the trial operation period.

Through the application of this lithium battery power supply system, HD Hyundai Heavy Industries has increased one of the most important performance metrics of submarines—submerged endurance—by more than 1.5 times. Additionally, the sustained underwater top speed has improved by more than three times.

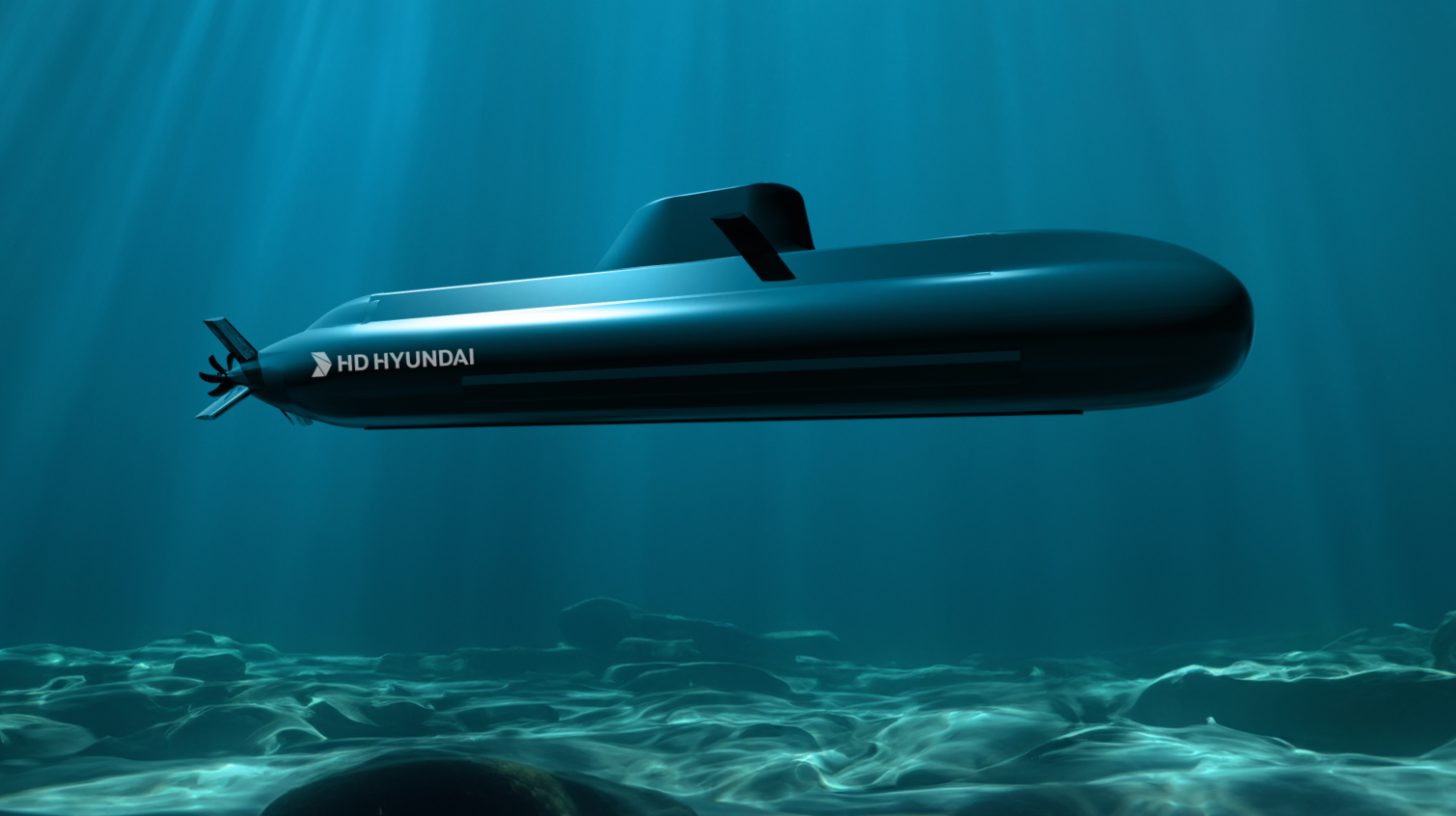

Based on the application of lithium batteries that have advanced submarine power supply technology and the experience gained from demonstrations, HD Hyundai Heavy Industries is actively promoting the development (R&D) of core technologies for export-type submarines to meet the demands of various countries.

A rendering of the HDS-2300, a submarine developed by HD Hyundai Heavy Industries

Accelerating the Development of Unmanned Surface Vessels: the Blue Ocean of the Global Warship Market

The development of unmanned vessels, regarded as a game changer for future naval warfare, is also in full swing. According to Allied Market Research, the global unmanned surface vessel market is projected to grow from $920 million in 2022 to $2.7 billion by 2032, with an annual growth rate of 11.5%

After partnering with Palantir, a top-tier company in the defense AI sector, in April to develop unmanned surface vessels (USVs), HD Hyundai unveiled 'TENEBRIS,' co-developed with Palantir, for the first time at the AI Expo for National Competitiveness in the U.S. this May.

The reconnaissance USV TENEBRIS, meaning darkness in Latin, signifies its role in conducting stealthy reconnaissance missions near enemy lines. It features a lightweight of 14 tons and a length of 17 meters, equipped with high-performance hardware (hull) and advanced AI. The development is aimed at completion by 2026.

HD Hyundai plans to maximize the USV's endurance performance and range to ensure it can be deployed anytime and anywhere without performance degradation, such as communication failures, despite changes in the maritime environment. Additionally, the goals include enhancing speed, payload capacity, and stealth performance.

Additionally, HD Hyundai plans to integrate its autonomous navigation and vessel integrated management system with Palantir's AI platform to achieve Mission Autonomy (AI-based mission autonomy), applying world-class advanced AI technology.

*Endurance Performance: The ability of a vessel to navigate its planned route or area without degradation of the functionality and performance of the equipment and systems onboard, regardless of maritime conditions, while effectively carrying out its mission.

A rendering of TENEBRIS